Fundraising 101

As I said in my first blog post, a CEO has two main jobs: Hiring and Fundraising.

After leaving Scale, I spent several years as a GP at Backend Capital, where we funded over 140 pre-seed and seed stage companies. I’ve been pitched by thousands of startups. After being on the founder side at Scale & Passes and the investor side at Backend, I’ve identified a few strategies to make fundraising rounds quick and cohesive.

There are already a lot of public resources about the financial nuances of fundraising, physical and emotional prep for fundraising, and crafting an effective pitch deck. Instead, I’m going to focus on strategies to get a first call with a VC and then quickly close a round. These tactics work best for pre-seed and seed stage companies without product-market fit. I even dug up some old screenshots from my Scale days 👀.

Ask for advice, not money.

Every time I’ve approached an investor with the end goal of getting a check, I’ve only asked for advice. The best investors may suspect that this tactic is being used, but you should remember that it’s an investor’s job to source good companies. Asking for advice, rather than seeking money, lowers the stakes of the call so you can better explain the nuances (and trajectory) of you company. And when you are ready to formally ask for money (if they don’t already ask for allocation in your next round), you will have have built rapport that makes your outreach more likely to get a response.

They might even pre-empt and offer money (without the ask) if they love you.

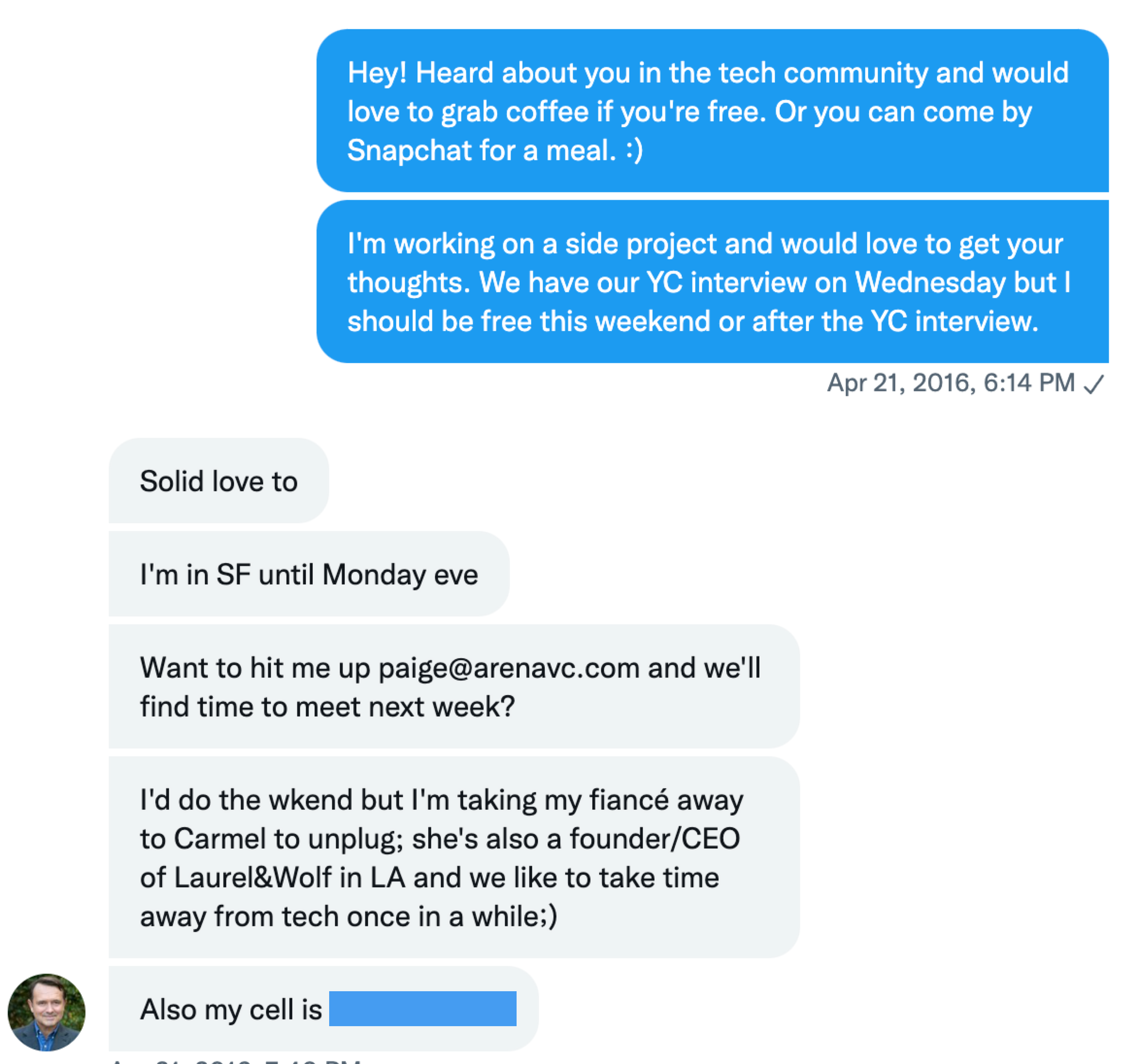

Years ago, I sought advice from an investor via cold DM right before the YC interview that would eventually lead to Scale (Fig. 1). I assumed that I wouldn’t be fundraising for the company for several more months, until after the YC batch concluded. Instead, he and I grabbed dinner and rambled about the future of artificial intelligence over an hours-long hike before he offered to invest on the spot. His initial offer was a place of faith in me, rather than in the merits of my pre-YC side project.

Pitch yourself, not the idea.

Ideas matter, but only up to a certain point. I learned this as a VC. You can invest in the smartest founders, but if their goal isn’t to build a company worth at least $10B, they are unlikely to give the financial returns a VC fund needs. If you are asking for money but planning to get acquired, you’re not thinking big enough.

It’s IPO or GTFO for VCs.

VCs are looking for companies that can be $10B+, not ones that are potentially going to exit for $300M. Remember, their returns follow the Power Law effect. That is not to say that there is no merit in aiming to build a 7 or 8-figure business. An exit at that price can be life changing for founders who avoided dilution. But the decision to bootstrap vs seek venture capital warrants an entirely separate discussion.

At the earliest stages of a company and/or a founder’s career, it can be difficult to tell if the founder will win with their first idea. Half of the companies in YC end up pivoting, and those that are agile and resilient enough to do so until finding PMF have matured into industry-defining companies (like Slack, Ginkgo Bioworks, and Scale).

I liken the process of pivoting to gradient descent: the best founders have the ability to observe trends, identify opportunities that stem from their comparative advantages, and ultimately keep moving when they are stuck at a local minima with limited upside.

Ideas are cheap, execution is expensive. Be rabid in your ambition when an investor is taking a bet on you as a founder.

Have a technical co-founder

This is quite straightforward. Startups die because they run out of money, and those with technical founders have lower burn rates because the engineering work can be done without outside hires.

Code and content are the only things that scale with zero marginal cost. Theoretically, a tech startup can last forever without outside money if the founder is couch-surfing and coding. (I might’ve also gotten some VC-sponsored meals by spamming my referral codes all over the internet to have near-zero burn 😬.)

Get warm intros

Warm intros to investors are always received better, particularly from an investor or angel who is also putting money into your company in the current round. Only ask for introductions from people you want associated with your company — this will be your first impression!

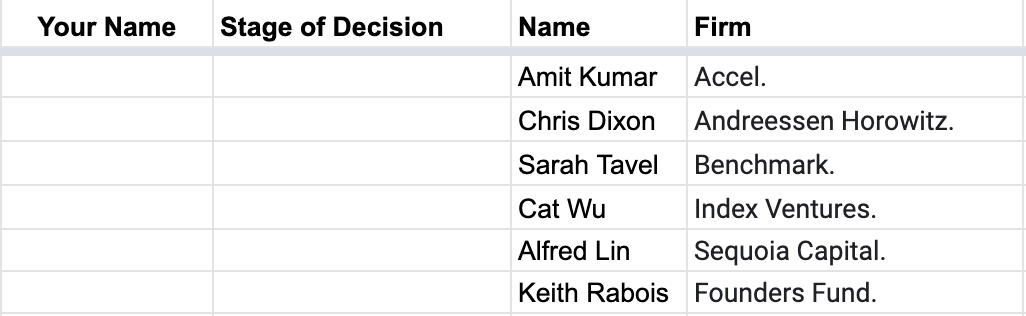

Create an investor CRM that lists funds/angels you think would be a fit for your company, whether that’s based on fund theme, previous investments in the same space as you, or check size. Pitchbook and Crunchbase are excellent resources for finding this information (and most universities offer their students free accounts to these sites that would otherwise cost >$10k a year per login). Once you’ve made your list of target investors, find mutual connections on your LinkedIn and ask for a warm intro. You can also share your investor CRM with close friends so they can directly note if they are able to make an introduction on your behalf.

Check that a target investor hasn’t backed a director competitor to you. Pursuing an investment from them could be a dead end because of conflicts of interest, or (worse) give them alpha into your strategy that gets passed along to your competitor!

It’s helpful to give the person making an intro a short blurb about your company and your personal background. This saves them time and maintains your control of how they explain your company.

The dreaded cold email

Sometimes you won’t have a warm intro. If you have to write a cold email, make it short & sweet with all necessary info. Here’s what I would write (assuming pre-product):

Hi! I’m Lucy Guo, an engineer and designer that dropped out of Carnegie Mellon (Computer Science & HCI). I’ve done work at Facebook, Quora, and Snap, and I’d love to get your advice about what I’m working on right now.

I’m building [one-liner] and your advice feels like it could be incredibly valuable after your experience at [company]. Huge fan of your work.

I’m available at the following times: Monday: 9:30 AM - 2:00 PM ET Tuesday: 10:00 AM - 1:00 PM ET Wednesday: 12:00 PM - 3:00 PM ET

If those times don’t work, let me know what does for you and I’ll make room in my schedule.

Thanks so much!

- Lucy

Shaan Puri has an excellent course on Power Writing, where he explains how to optimize cold emails. It is a learnable skill.

Leverage FOMO

There are a lot of ways to create FOMO when you communicate to investors. Causally mention how busy you are with onboarding new customers or fielding meetings on Sand Hill Road. You’re telling them that your round is hot without saying the words.

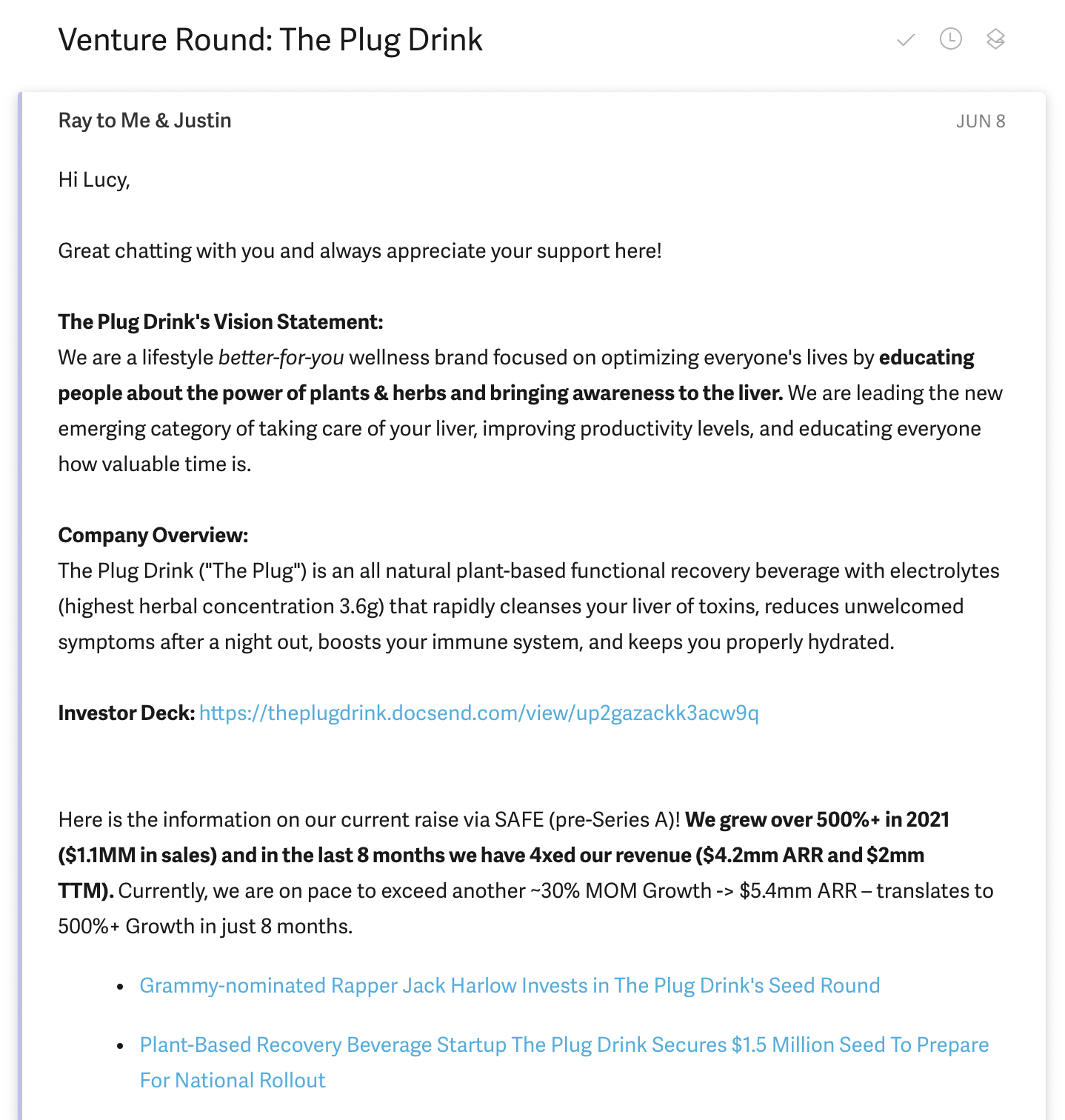

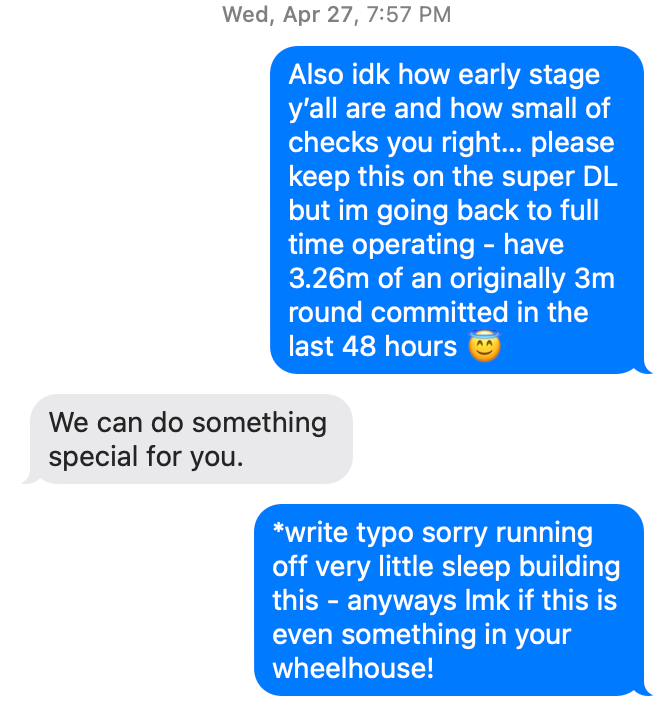

One easy way to do this is with the “kickstarter” method. If you start with a smaller target round, it’s easier to be oversubscribed (the ultimate driver of FOMO). Just don’t go too overboard like we did at Passes. A $3M round became a $3.5M round then a $5M round and then… an $8M round. This is probably my fault — I meant to raise a $3M round but created so much FOMO from texts like this (Fig. 5) that everyone kept seeking allocation. That was unintentional, but the FOMO is so strong that I’m still having people ask to invest daily.

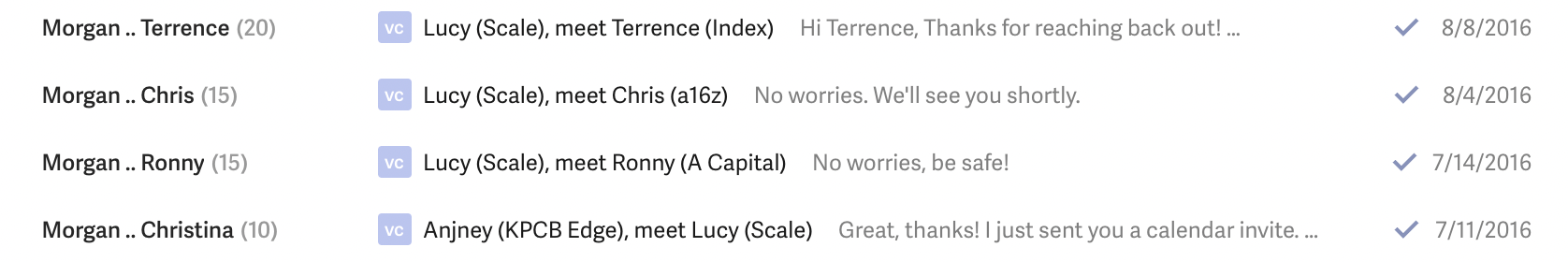

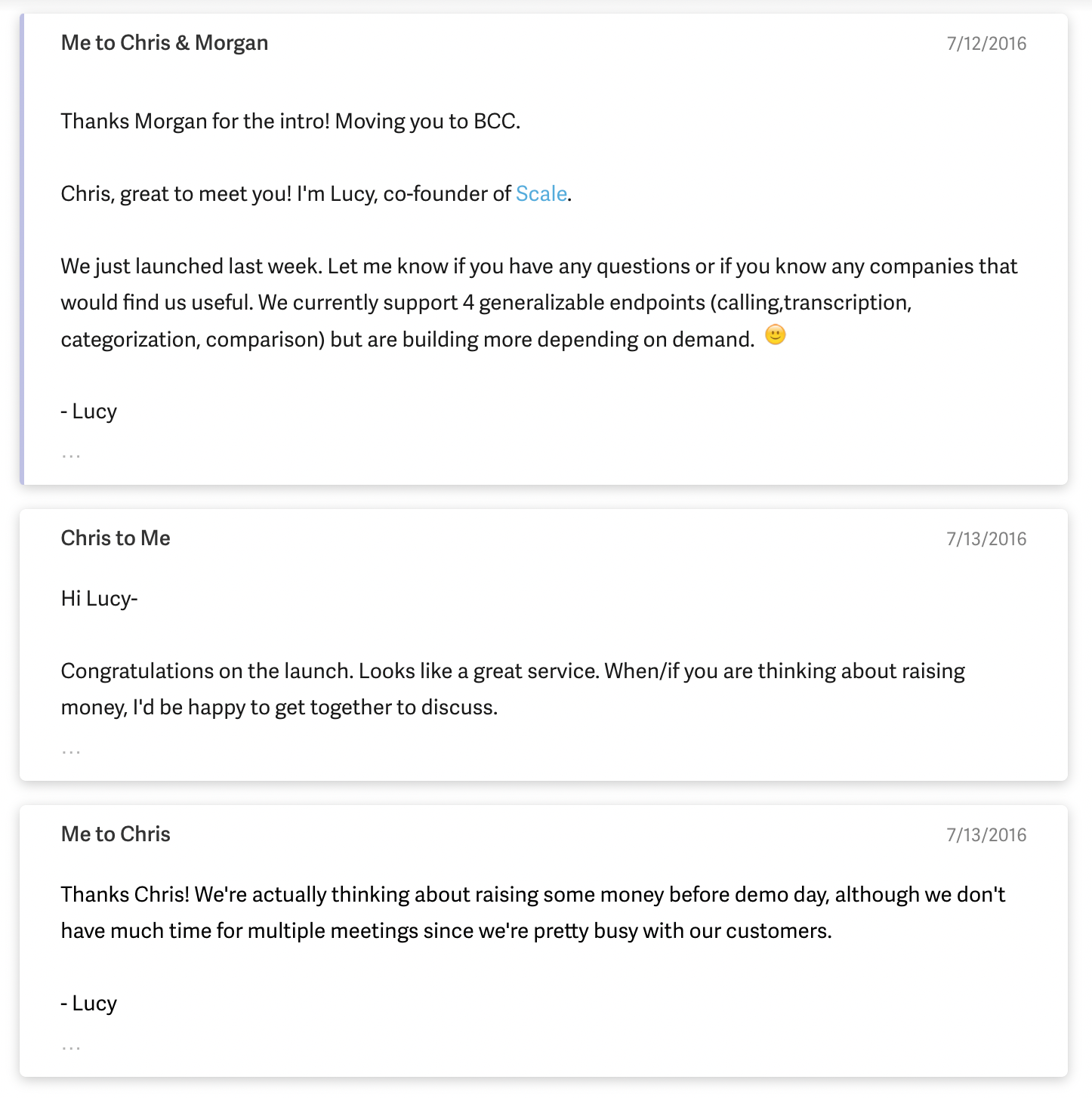

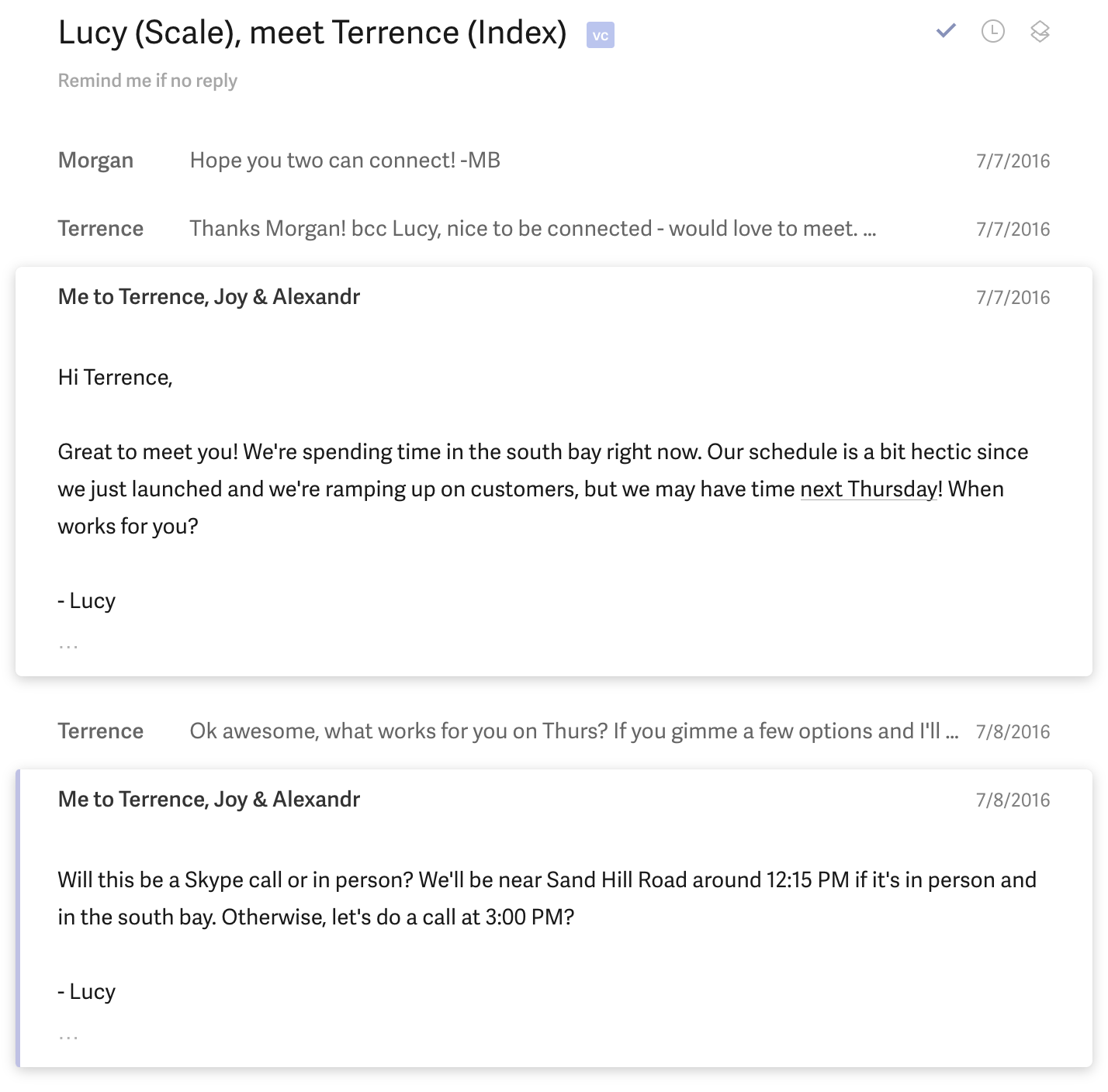

Here are examples of how I generated FOMO at Scale.

Fundraising a second time was much simpler (people love second-time founders). Inbound requests for meetings from investors continue to today, despite closing the round weeks ago. Friends and acquaintances became upset that I didn’t tell them about Passes earlier. And this was when the markets were in free-fall and people were getting terms sheets pulled.

FOMO (+ being a 2nd time founder) is powerful.

Throw a party (round)

In the old days of fundraising, you absolutely needed a lead investor to complete a seed round. Angel checks weren’t enough to fill a $2-5M round.

But investor money has been commoditized. AngelList has made it easy for anyone to spin up a fund or SPV. There are more micro-funds than ever before (seriously, even 17-year old TikTokers have their own funds now).

And quite frankly, micro-funds do a lot less diligence. They often rely on a spray-and-pray approach, which is possible with smaller checks that are eager to be deployed. Many multi-stage funds, on the other hand, rarely do seed checks (only 1-2 per year per partner).

By raising a party round, you’ll end up raising the same amount much faster! And you can raise one with PartyRound (Disclaimer: I am an investor).

Make sure to follow up

Use DocSend to track who has opened your deck. Follow up over email with everyone that viewed it.

VCs lose track of things for all sorts of reasons. They might be chasing another deal, helping a portfolio company, dealing with a family emergency, or (more likely) partying on a yacht in Mykonos (kidding… ish).

Transparently, if you already had a conversation and then get ghosted, they probably weren’t that intrigued. But still follow up. The worst you can get is a no. Best case, a term sheet!

Fundraising is a skill that can be learned. And I just happen to be really damn good at it. 🤷🏻♀️

In summary:

- Get warm intros

- Ask for advice

- Pitch yourself

- Drive FOMO

- Close the round and build a 🚀

To all the founders reading this: I’m still angel investing, but only taking warm intros. Have a friend shoot a forwad-able blurb over. 😊

- #LFGuo